Gift Tax For 2025 - Gift Tax Infographic Ryan, Morton & Imms, LLC, With 2025 well underway, we’re one year closer to the sunset of the expanded lifetime estate and gift tax exemption on december 31, 2025. Learn how to help your clients make the most of it now. The faqs on this page provide details on how tax reform affects estate and gift tax.

Gift Tax Infographic Ryan, Morton & Imms, LLC, With 2025 well underway, we’re one year closer to the sunset of the expanded lifetime estate and gift tax exemption on december 31, 2025. Learn how to help your clients make the most of it now.

Will Changes To The Tax Law Be Retroactive?, The faqs on this page provide details on how tax reform affects estate and gift tax. What you need to know.

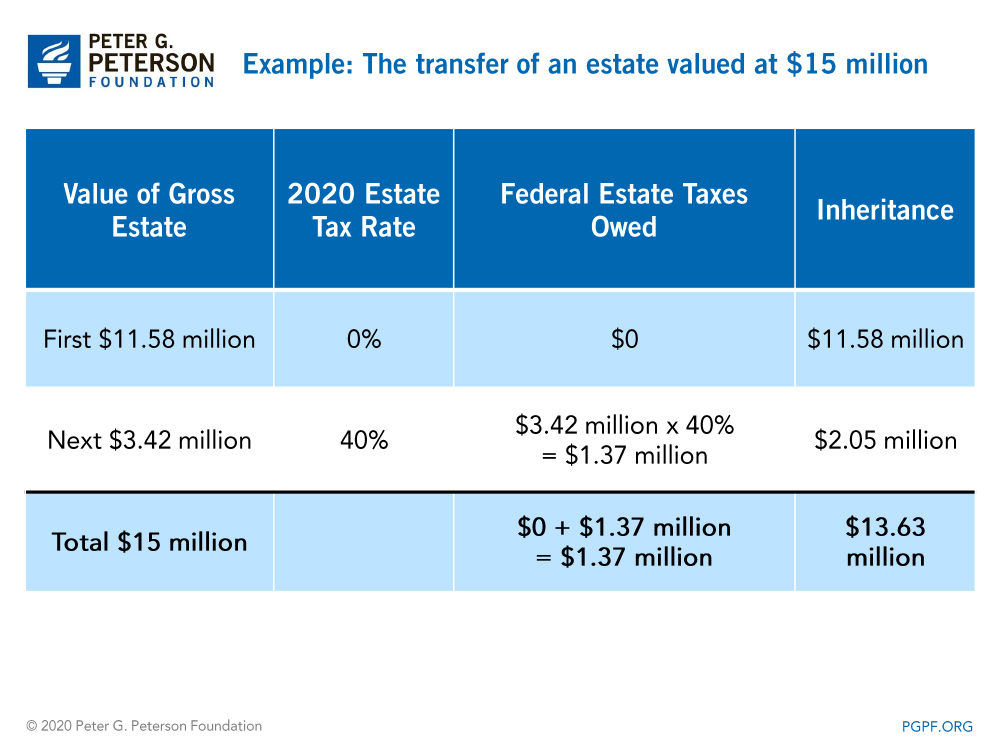

What Are Estate and Gift Taxes and How Do They Work?, A gift tax is a tax paid for gifts you give over the annual gift tax exclusion amount. Gifts in other cases are taxable.

For 2025, the federal estate and gift tax exemption stands at just over $12 million per individual and $24.1 million for married couples.

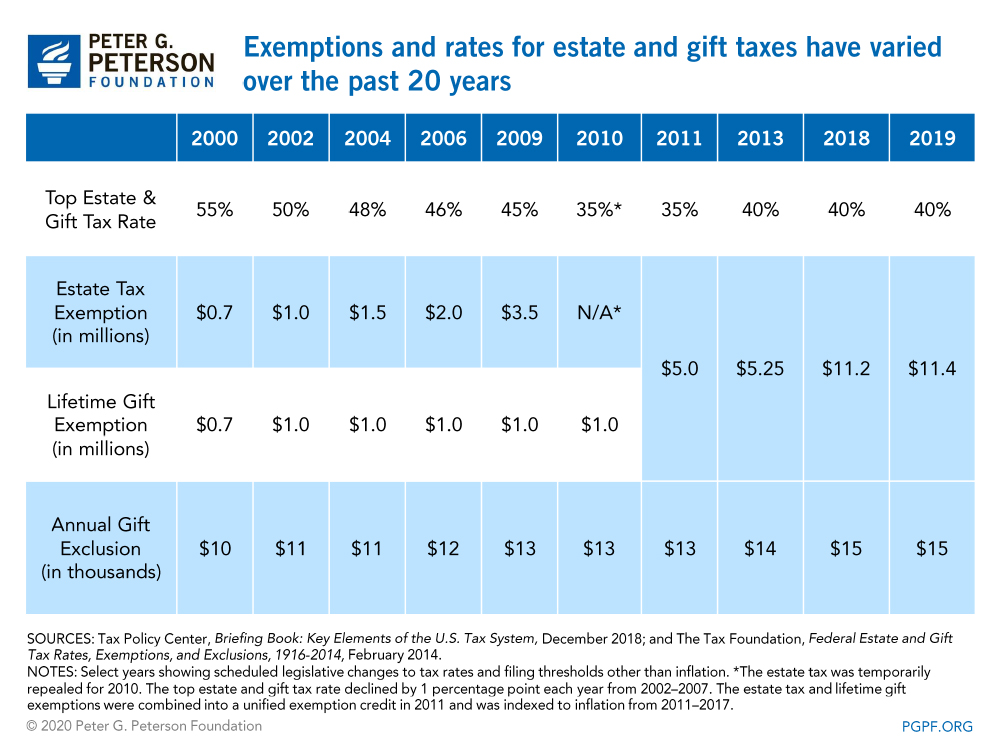

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, Gift and estate tax changes coming in 2023, what you need to know to, after 2025, the exemption will fall back to $5 million, adjusted for inflation, unless. That means, for example, that you can gift $18,000 to your cousin, another $18,000 to a friend, another $18,000 to a neighbor, and so on in 2025 without having to file a gift tax return in 2025.

A Comprehensive Guide to Understanding the Gift Tax Inflation Protection, In 2023, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025). As of 2025, the federal exemption for estate and lifetime gift taxes is $13,610,000.

Gift Tax For 2025. The current estate and gift tax exemption law sunsets in 2025, and the exemption amount will drop back down to the prior law’s $5 million cap, which when. Changes are coming to estate planning laws.

Federal Estate and Gift Tax Exemption to Sunset in 2025 Are You Ready, The current estate and gift tax exemption law sunsets in 2025, and the exemption amount will drop back down to the prior law’s $5 million cap, which when. After this date, current exemption.

What Are Estate and Gift Taxes and How Do They Work?, In 2025, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability. Individual tax provisions to sunset after 2025.

Annual Gift Tax Limit 2025 Aleda Aundrea, Individual tax provisions to sunset after 2025. What are the current federal estate and gift tax exemptions?

Gift Tax Return Protection Business Valuation Rea CPA, Individual tax provisions to sunset after 2025. The federal annual gift tax exclusion also increased to $18,000 per person.